sacramento property tax rate 2020

As a result the assessed value of a new residence is the same as the purchase price. Get Record Information From 2022 About Any County Property.

Sacramento Mass Shooting Supercharges Crime Debate Calmatters

Ad Find Sacramento County Online Property Taxes Info From 2022.

. Please make your Property tax payment by the due date as stated on the tax bill. Total tax rate Property tax. Two Family - 2 Single Family Units.

For comparison the median home value in. Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide. A delinquency penalty will be charged at the close of the delinquency date.

They can be reached Monday -. If you value your property at 200000 and the property tax rate is 81 then the total property tax on the property would be 1620 per year. The property tax rate in the county is 078.

Two Family - 2 Single Family Units. Permits and Taxes facilitates the collection of this fee. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Property taxes are a one-percent tax on a propertys assessed value under California law After the deduction of property tax exemptions for homeowners disabled veterans and charitable. Sacramento County collects on average 068 of a. Tax Collection Specialists are.

As we stated previously. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and.

View the E-Prop-Tax page for more information. This is the total of state county and city sales tax rates. Sacramento California sales tax rate details The minimum combined 2021 sales tax rate for Sacramento California is 875.

In West Sacramento the sales tax rate is 825 percent which includes the state-mandated 725 percent plus four separate ¼ cent voter-approved sales tax measures that. For a home valued at 350000 the median property tax in Sacramento County California is 2380 per. Equalized Rolls - District Valuation Report.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1.

Tax bill amounts due dates direct levy information delinquent prior year tax information and printable payment stubs are available on the Internet using your 14-digit parcel number at e. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Sacramento county tax rate area reference by primary tax rate area.

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates.

Sacramento Tourism Marketing District Stmd

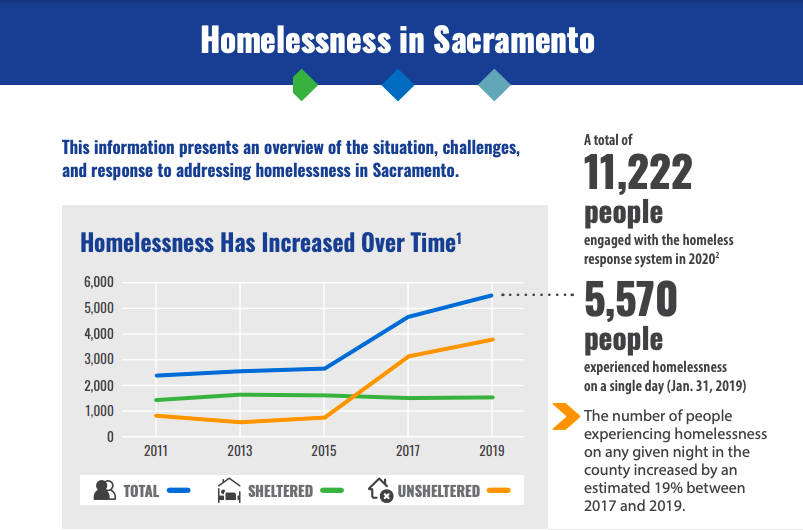

Sacramento Homeless Grows As City County Spend Million More On Accommodating Them California Globe

Sacramento County Ca Property Tax Search And Records Propertyshark

California Crypto Oversight Bill Moves Closer To Becoming Law Bnn Bloomberg

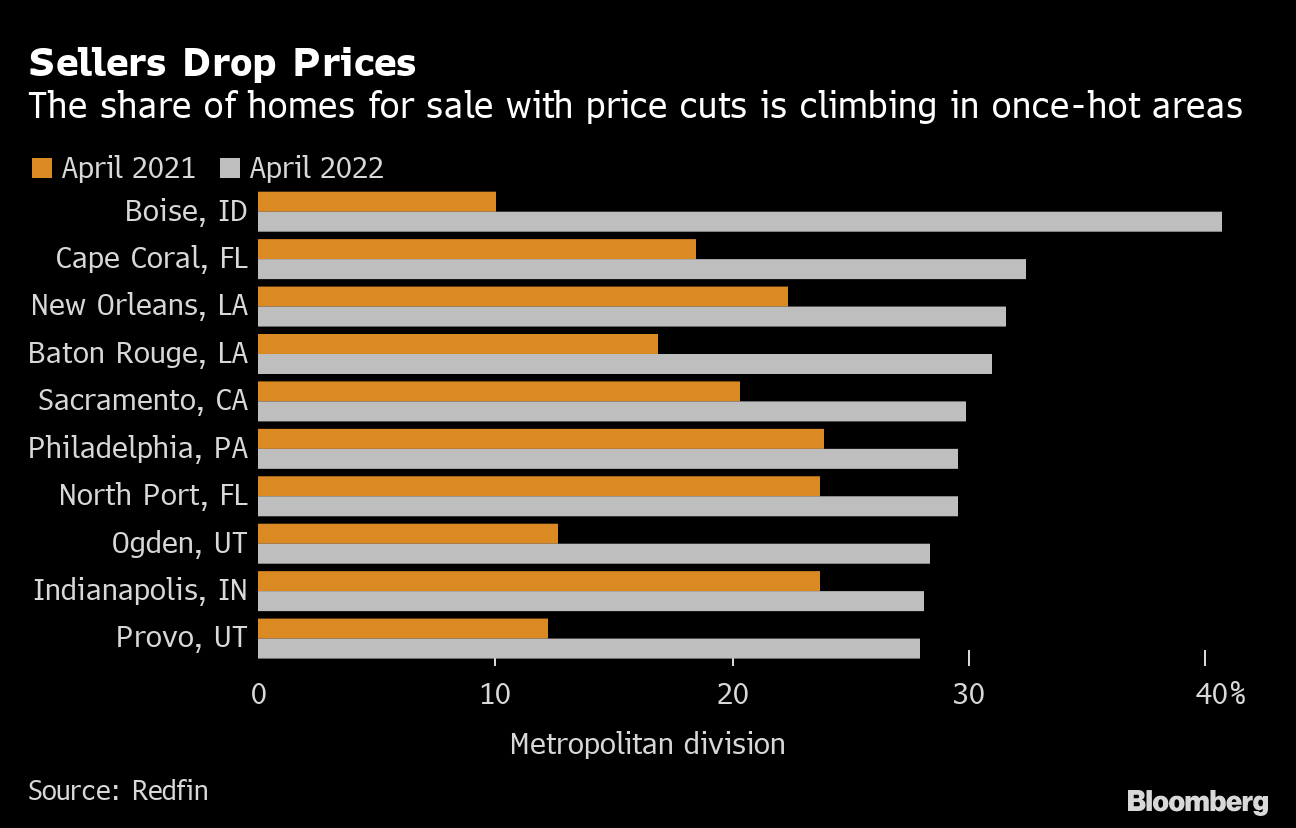

Cooling Real Estate Housing Markets In Us Uk Risk Deeper Global Economic Slump Bloomberg

Sacramento Cost Of Living 2022 Is Sacramento Affordable Data

Services Rates City Of Sacramento

Map Of City Limits City Of Sacramento

Sacramento Valley Struggles To Survive Record Water Cuts Calmatters

Why November Could Mean The End Of Prop 13 And An 11 4 Billion Increase In Property Taxes For Commercial Owners And Tenants Sacramento Business Journal

Search The Bee S Online Archives Sacramento California College

2022 Best Sacramento Area Suburbs For Families Niche

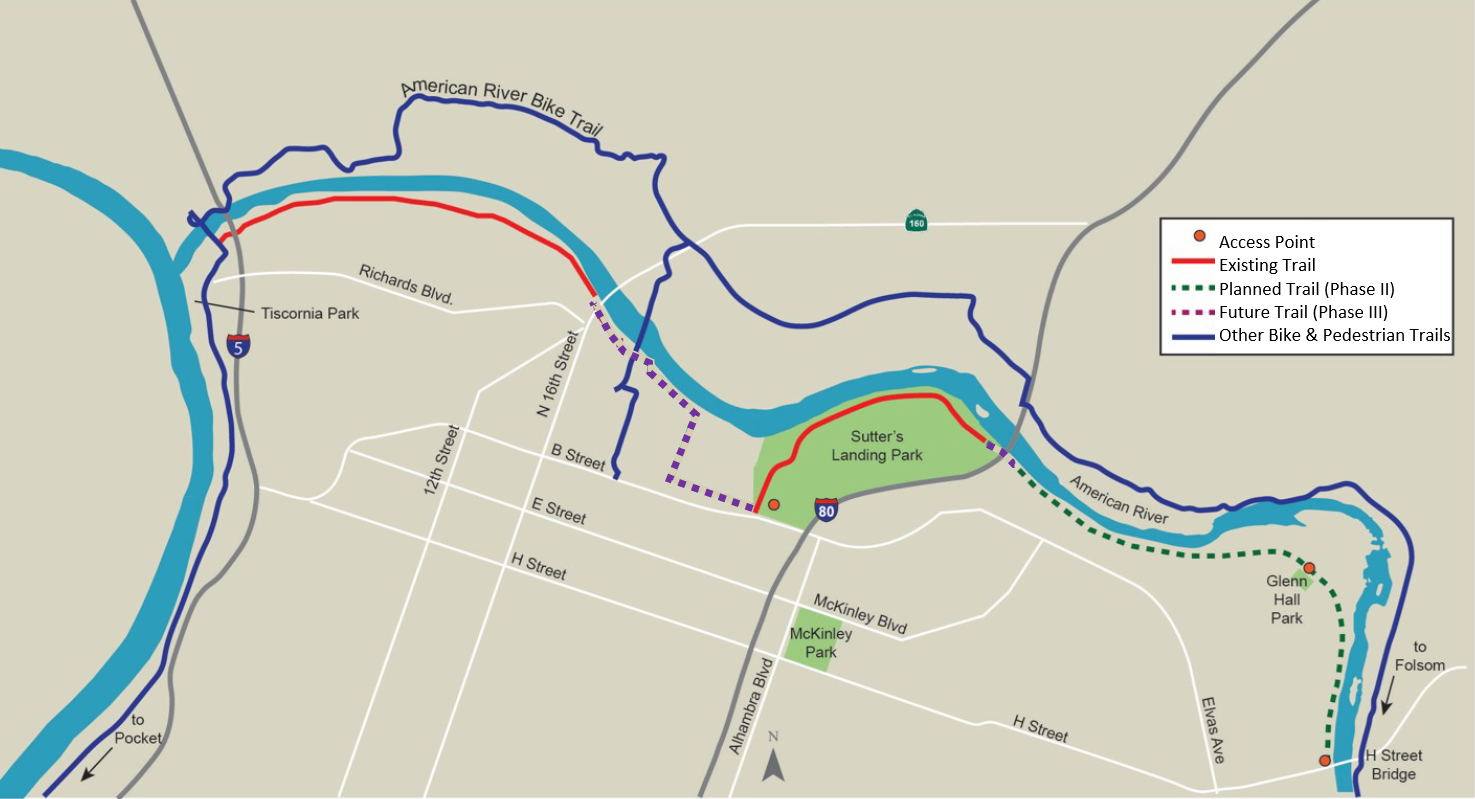

Two Rivers Trail Phase Ii City Of Sacramento

The Final Walkthrough Of A Home Is Something That Raises Questions From Both Buyers And Sellers In This Article Helping People Real Estate Agent Informative